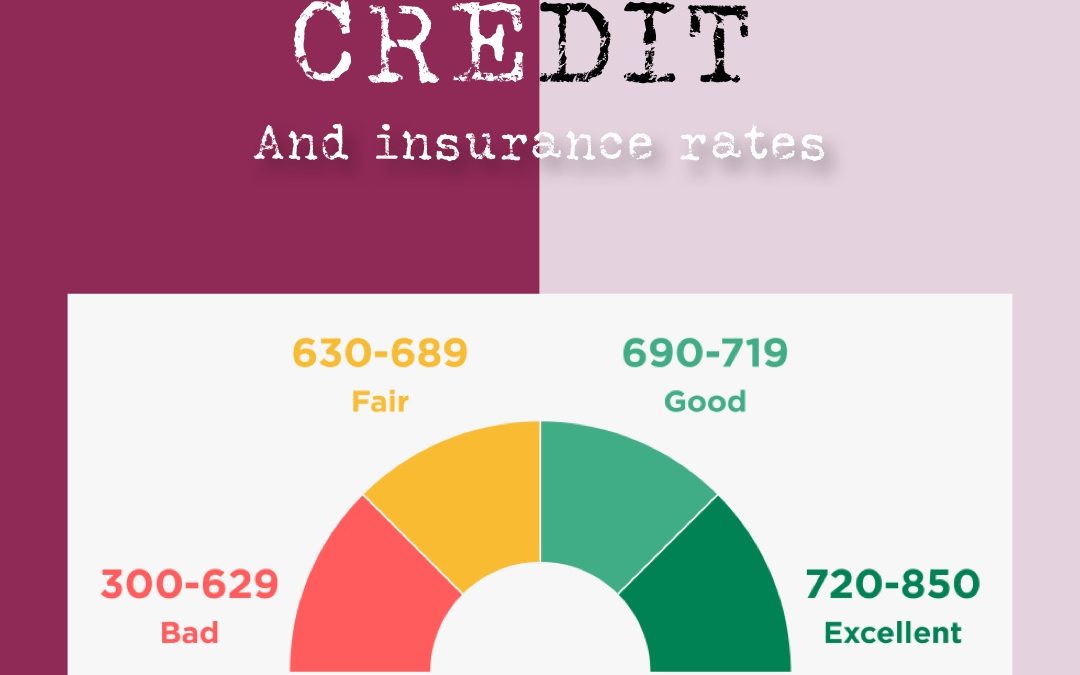

Insurance scores and credit scores are not the same thing. Credit scores predict credit delinquency while insurance scores predict insurance losses.

Both, however, are calculated from information in a credit report, such as outstanding debt, bankruptcies, length of credit history, collections, new applications for credit, number of credit accounts in use, and timeliness of debt repayment.

Insurers or scoring agencies then calculate the insurance or credit score by assigning differing weights to the favorable or unfavorable information in the credit report.

Information such as income, ethnic group, age, gender, disability, religion, address, marital status and nationality are not considered when calculating an insurance score.

What Is Credit Measuring Anyway?

Credit and insurance scores measure how well individuals manage their money—not how much money they make. Actuarial studies show that how a person manages his or her financial affairs is a good predictor of insurance claims.

Statistically, people with a low “insurance score” are more likely to file a claim.

For additional information about insurance industry or statistics, visit this related article or other blog posts on iii.com

Please let us know how we can best serve you in your personal or business insurance needs or have any questions related to your business’ activity.

J. M. Whitney Insurance is an independent insurance agency located in Watertown, Massachusetts. Give us a call, stop by, or request a quote online to find out how much we can save you on your insurance.

If you liked this blog, stay tuned for more from J.M. Whitney Insurance!

Visit our social media pages for additional information and tips!

@jmwhitney on Facebook, Instagram, Twitter or LinkedIn