Workers’ compensation is essentially benefits for employees should they fall ill or get hurt on the job. How it works seems complicated but it isn’t. Let’s dive in.

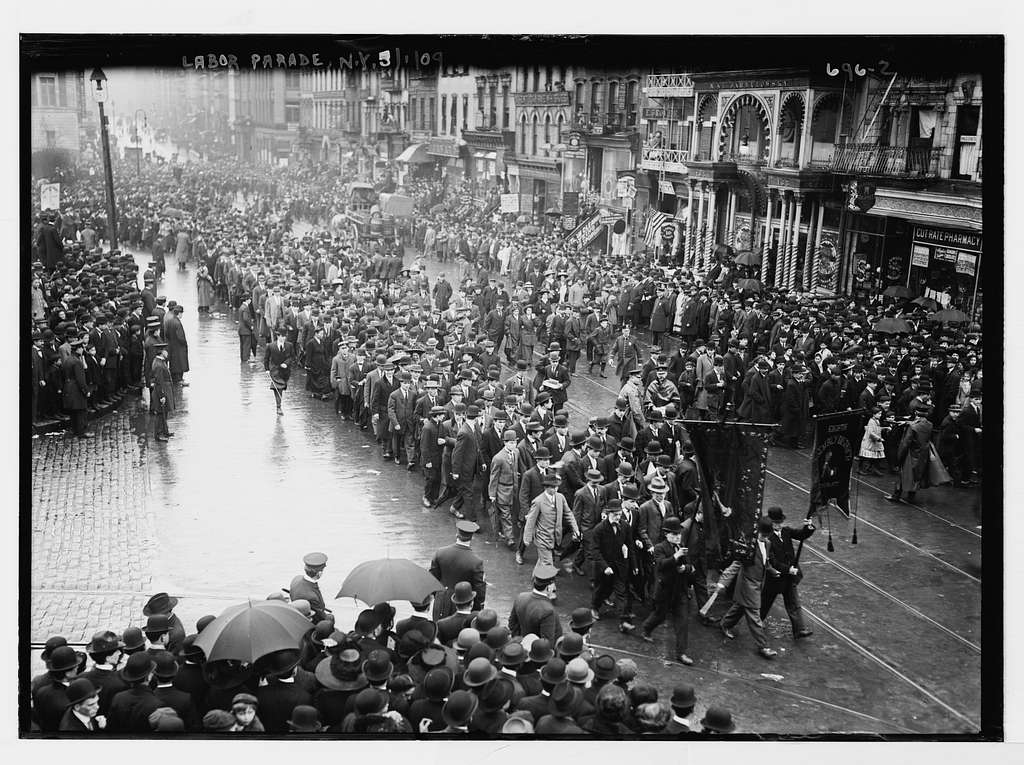

In the Beginning

Before workers’ rights, unions and all sorts of federal regulation put protection in place for workers, employees got sick and/or hurt on the job quite frequently.

Today, while there is less risk involved for many occupations, there is still a chance of the unexpected. In fact, almost 50% of us will undergo an unexpected, unplanning life change in our lifetime not once but twice! There’s a reason why insurance company ads often tout “prepare for the unexpected.”

Cue Insurance for Businesses

In addition to a basic BOP- business owners’ policy, workers’ compensation is often something important to add to the policy.

1) The policy will allow an ill or hurt employee to notify their employer of the issue, 2) the employer will then (call us) and file a claim. 3) The claim is investigated. 4) The employee is then paid or has their bills covered, depending on the situation.

Submitting the Claim

Filing a claim has never been easier. No headache required!

Just contact us by clicking here, or give our office a call. Our years of expertise and service to the community allow us to handle the stress and paperwork so you don’t have you. We make sure to have the policy align with state laws and regulations for Massachusetts. We’ll also thoughtfully answer any questions you may have about the process. Don’t hesitate to reach out.

J. M. Whitney Insurance is an independent insurance agency located in Watertown, Massachusetts. Give us a call, stop by, or request a quote online to find out how much we can save you on your insurance.

If you liked this blog, stay tuned for more from J.M. Whitney Insurance!

Visit our social media pages for additional information and tips!

@jmwhitney on Facebook, Instagram, Twitter or LinkedIn

![]()